Decentralization Explained: Why This Core Crypto Principle Matters in 2025

The Foundation of Crypto's Promise

In a world where power increasingly concentrates in the hands of a few tech giants and financial institutions, decentralization stands as the philosophical cornerstone of cryptocurrency's revolutionary potential. But what exactly does this concept mean in practice, and why does it matter more than ever in 2025?

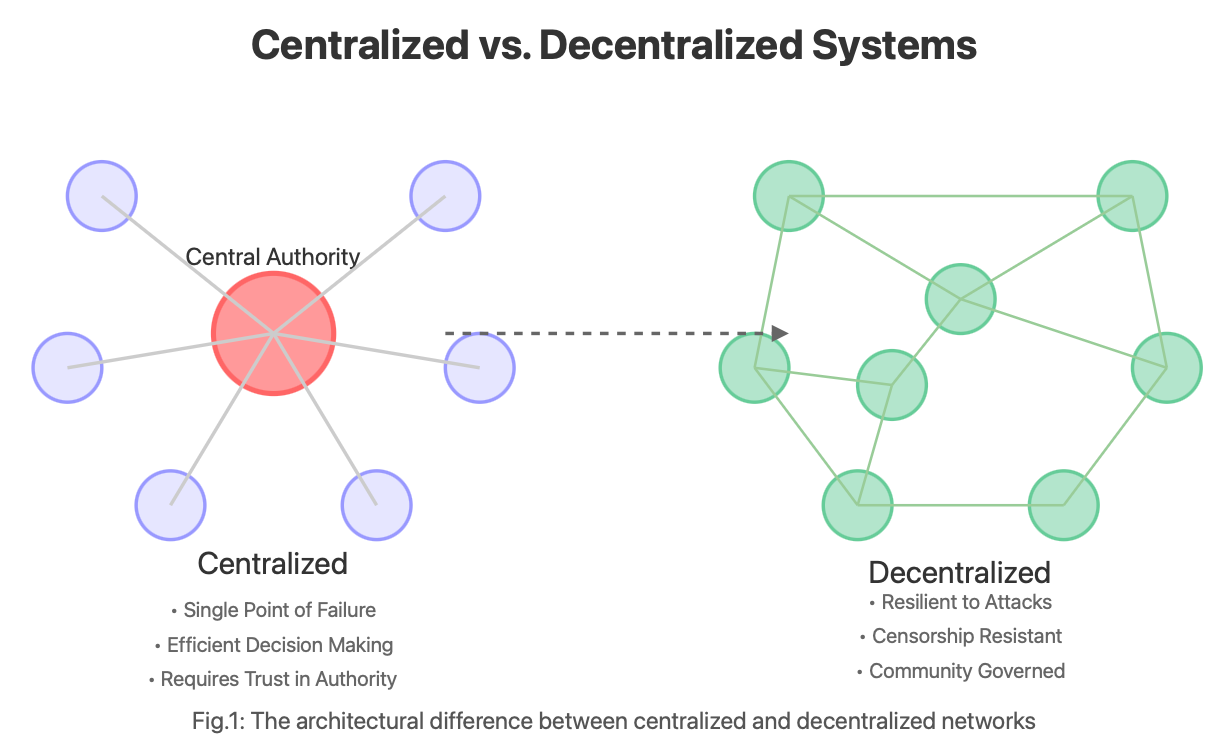

Decentralization represents the distribution of power, control, and decision-making across a network rather than concentrating it within a single entity. This principle isn't just technical jargon—it fundamentally reshapes how we think about trust, authority, and human coordination in the digital age.

Decentralization vs. Centralization Visualization

The Three Pillars of Decentralization

Decentralization isn't just a single feature but operates across three critical dimensions:

Architectural Decentralization: This refers to how many physical computers make up the system. Bitcoin's network spans thousands of nodes across the globe, making it nearly impossible to shut down. In contrast, traditional banking relies on a few centralized data centers.

Political Decentralization: This determines who controls the system. In truly decentralized networks like Bitcoin, no single entity can unilaterally change the rules. Protocol changes require broad consensus among participants.

Logical Decentralization: This asks whether the system's interfaces and data structures present a single cohesive unit or can be divided into independent parts. Decentralized systems like cryptocurrencies can function even if they're split in half.

DeFi Transaction Flow Diagram

Why Decentralization Matters More in 2025

Recent developments have underscored decentralization's growing importance:

Financial Sovereignty: As we've witnessed record-breaking monetary expansion by central banks and increasing restrictions on cash transactions, decentralized cryptocurrencies provide a hedge against currency debasement and financial surveillance.

Censorship Resistance: With social media platforms and payment processors increasingly acting as gatekeepers of acceptable speech and commerce, decentralized networks offer uncensorable communication and transaction channels.

Resilience Against Single Points of Failure: The major cloud service outages of 2024 demonstrated the vulnerability of centralized infrastructure. Decentralized networks, by design, remain functional even when significant portions go offline.

Real-World Applications in Action

Decentralization isn't merely theoretical—it's being applied in transformative ways:

Decentralized Finance (DeFi): Platforms like Uniswap and Aave have created financial systems without banks, enabling lending, borrowing, and trading through smart contracts rather than corporate intermediaries.

Decentralized Identity: Solutions like Ethereum Name Service and Soulbound Tokens are creating self-sovereign identity systems where individuals—not Google or Facebook—control their digital presence.

Decentralized Storage: Networks like Filecoin and Arweave distribute data across thousands of nodes, enhancing resilience and reducing the risk of censorship.

The Decentralization Paradox

Despite its transformative potential, decentralization faces challenges. Perfect decentralization often sacrifices efficiency and user experience. The most successful crypto projects of 2025 are finding the optimal balance—decentralized enough to preserve core benefits while practical enough for mainstream adoption.

As we navigate increasingly uncertain geopolitical and economic landscapes, understanding and leveraging decentralization isn't just for crypto enthusiasts—it's becoming essential knowledge for anyone concerned about digital freedom, financial independence, and technological resilience.

The revolution isn't just decentralized—it's inevitable.